Services

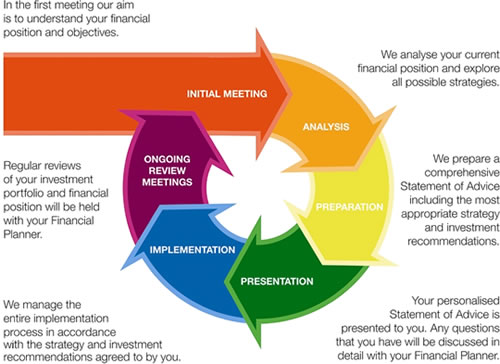

While developing a customized financial program, we will walk you through a step-by-step process that will help you feel confident in your decisions.

Once your goals have been established, we will customize appropriate strategies to suit your vision and objectives. We can help you execute a sound financial program utilizing the following products and services:

Financial Planning includes:

- Setting Goals

- Income and Expense Management

- Cash Flow Analysis

- Investment Management Strategies

- Insurance Needs Analysis

- Retirement Planning

- Estate Planning

- Tax Planning

Investment Management:

Now that you have a vision for your current needs and your future goals, it's our role to help you create an investment strategy that aims to help you achieve your dreams. We will start by showing you how to maximize the assets you have already accumulated. Next, we will introduce you to, and educate you on, new investment opportunities. Then we will continue to work with you as your accounts mature and your needs change.

- Wealth Management

- Managed Accounts

- Stocks, Bonds, Mutual Funds, and Exchange Traded Funds

- Real Estate Investment Trusts (REIT)

- Alternative Strategies

Estate Planning:

It is never too early to start planning to care for your loved ones after you have passed. The right plan will help ensure that your future wishes are carried out, while continuing to help you meet your current needs. We can help you create, and implement, an estate plan that:

- Ensures that your assets are distributed the way you want

- Minimizes probate taxes and expenses

- Keeps current with changing laws and taxes

- Can incorporate charitable giving goals

Retirement Planning:

Whether in your working years (accumulation phase) or retirement years (distribution phase), proper retirement planning can help ensure that you will not outlive your income. We will help you determine and implement a plan that seeks to help you achieve your retirement goals. Let us help you with:

- IRAs

- Rollover IRA - from your previous employer's sponsored retirement plan (such as 401k plans, 403b plans, and 457 plans)

- Traditional IRA

- Roth IRA

- Annuities

- Fixed

- Variable

- Equity Indexed

- Immediate

- Corporate Sponsored Plans

- Single-K or Uni-K

- Simplified Employment Pension (SEP)

- 401k

- Simple IRA

- DROP Program Assistance

Insurance Planning:

- Life Insurance

- Long Term Care Insurance

- Nursing Home Care Through LTC

- Disability Insurance

Tax Planning:

When analyzing, evaluating, and making investment portfolio recommendations, tax consideration is essential. We work with you and your tax professional (CPA or accountant) so that we may help you maximize your tax savings. We can show you how to maximize your savings in your retirement accounts (401k, IRA, and other qualified retirement plans), choose tax-efficient investments, and incorporate tax planning into your overall financial picture.

- Retirement Plan Analysis

- Referrals to qualified Tax Professionals

"together...soaring to new heights"